Inclusive conservation finance models

A loan recipient in Uganda who started ginger farming with micro-loans. Credit - Silver Tumwa.

Scaling community-based inclusive conservation finance models in Uganda and Tanzania

Inclusive conservation finance

Inclusive Conservation Finance (ICF) refers to financial instruments, such as micro-loans and insurance, designed to achieve conservation goals while ensuring broad participation and delivering clear economic benefits to diverse stakeholders, especially marginalised and underrepresented communities. Although micro-loan schemes have been widely used in international development for decades, their impact on biodiversity outcomes has often been unclear. This is where the ICF models in Uganda and Tanzania stand out.

PFOA Model: Northern Albertine Rift, Uganda

Since 2017, Fauna & Flora has supported Private Forest Owner Associations (PFOAs) in the Northern Albertine Rift, Uganda, to establish a micro-loan mechanism. This initiative provides affordable loans to community members engaged in conservation activities. As a result, hundreds of community members have accessed loans to develop nature-friendly enterprises and have been incentivised to participate in tree planting efforts, monitor human-primate interactions, and track chimpanzee sightings and threats. Over the past five years, there has been a twelvefold increase in community members involved in conservation actions. These micro-loans have enabled community members to set up businesses that align with conservation goals, integrating economic development with environmental sustainability.

A loan recipient in Uganda shared, "My husband abandoned me, and I was left to raise my children on my own. The PFOA loan scheme provided me with micro-credits to pursue income-generating activities based on planting trees. Now, I have income from planted trees, which helps me manage household financial needs and my children’s education."

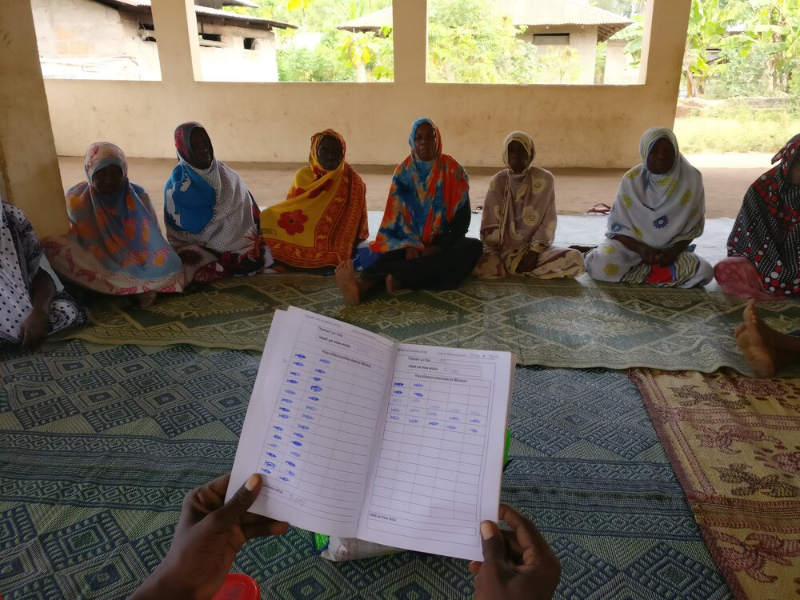

MKUBA Model: Pemba Channel Conservation Area, Zanzibar

In Zanzibar, since 2017, the Mwambao Coastal Community Network, Fauna & Flora, and Greenfi have established MKUBA community groups (Kiswahili for “Fund to steward for the Ocean”). These groups provide affordable micro-loans to community members who commit to planting mangroves and participating in other conservation activities of their choice. This mechanism has enabled community members to pursue livelihood activities while incentivising their participation in conservation actions. The micro-loans have supported various small businesses, contributing to both local economies and environmental conservation. To meet local capacity needs, the model adopted innovative approaches such as using symbols like “fish” instead of numeric figures in the record-keeping system to accommodate illiterate community members.

Future directions

The next step for these community-based lending models is to enhance their scalability to create a positive impact on biodiversity and communities across the landscape. The project aims to advance the scalability of these models by focusing on three main pillars:

- Governance

Robust governance structures: Ensuring robust governance of the current pilots before scaling up and adding more communities. Regular governance assessment exercises were conducted to improve transparency, accountability, and gender balance in decision-making.

Increased representation: Women now hold key leadership positions in the MKUBA management committees, including roles such as chairperson and environmental officer. This shift has led to increased representation of women in leadership positions and active participation in decision-making processes. Private Forest Owner Association Management Committees also ensure women take part in leadership roles to aid in decision-making.

Youth engagement: Youth participation in both project sites is at a good level, with young leaders receiving peer support and mentorship from older members. Youth engagement in conservation and restoration activities has grown, improving their attitudes towards personal development, savings, and financial management.

- Conservation impact

Clear conservation agreements: Both Uganda and Zanzibar models had clear but informal conservation agreements. Community members regularly participated in conservation actions such as tree planting and patrolling as a prerequisite to access the loans. These agreements were revisited to ensure consensus and formalise the terms.

Addressing major drivers of unsustainable resource use: Focus group discussions identified poverty, lack of awareness, and poor enforcement as major drivers of unsustainable natural resource use. Proposed solutions include enhanced environmental education, stricter law enforcement, increased access to patrol resources, and stronger cooperation among stakeholders. Some of these solutions are already in action, while others will be incorporated into future programmes.

- Reducing transaction costs

Digital tools for monitoring: In Uganda, Fauna & Flora developed a financial and environmental compliance monitoring system using the freely available KoboToolbox platform involving community at early stages of app tool development. A protocol was developed to ensure technology is equitably accessible to all community members. Additional training was provided to those less familiar with smartphone use, such as elderly women and men. The tool includes a section to auto-calculate the actual interest amount payable, improving transparency and is highly appreciated by the community. This tool has been rolled out for communities to use, with PFOA and Village Savings and Loans Association (VSLA) leaders trained in data entry. All members of 10 pilot VSLAs are already registered on the online tool.

Engagement with banks and tourism operators: Engagement with banks and tourism operators as part of this project has opened promising avenues for future partnerships with Inclusive Conservation Finance (ICF) groups, aiming to reduce dependency on donor funding for scaling up.

The scalability of ICF models has reached a pivotal moment. Initially set to attain a "moderate" scalability score by the end of the project, the models implemented in both sites have surpassed this target, achieving a "high" score according to the VUNA Scalability Assessment Framework. This notable success reflects the robustness and potential for these models to be scaled up further, creating a sustainable impact on biodiversity and local communities.

Such grassroots-led inclusive finance models are crucial for ensuring conservation finance achieves long-lasting impacts by reaching the intended recipients: local communities.

Written by Kiran Mohanan, Mrunmayee Amarnath, Tanguy Nicolas, Lorna Slade, Hope Beatty, Rogers Niwamanya, Abubakar Masoud, and Cath Lawson. For more information on this Darwin Initiative Innovation project DARNV010, led by Fauna & Flora, please click here.

Back

Back